North-South Commuter Railway (NSCR): Modern Train Network Connecting Luzon Island

North-South Commuter Railway (NSCR): Modern Train Network Connecting Luzon Island India launched Bharat Taxi Service as First Cooperative-Owned Digital Mobility Platform

India launched Bharat Taxi Service as First Cooperative-Owned Digital Mobility Platform India places World’s First Live Commercial Order for Hyperloop-Based Cargo Logistics

India places World’s First Live Commercial Order for Hyperloop-Based Cargo Logistics How Weigh-in-Motion Systems Are Revolutionizing Freight Safety

How Weigh-in-Motion Systems Are Revolutionizing Freight Safety Women Powering India’s Electric Mobility Revolution

Women Powering India’s Electric Mobility Revolution Rail Chamber Launched to Strengthen India’s Global Railway Leadership

Rail Chamber Launched to Strengthen India’s Global Railway Leadership Wage and Hour Enforcement Under the Massachusetts Wage Act and Connecticut Labor Standards

Wage and Hour Enforcement Under the Massachusetts Wage Act and Connecticut Labor Standards MRT‑7: Manila’s Northern Metro Lifeline on the Horizon

MRT‑7: Manila’s Northern Metro Lifeline on the Horizon Delhi unveils ambitious Urban Mobility Vision: Luxury Metro Coaches, New Tunnels and Pod Taxi

Delhi unveils ambitious Urban Mobility Vision: Luxury Metro Coaches, New Tunnels and Pod Taxi Qatar approves Saudi Rail Link Agreement, Accelerating Gulf Railway Vision 2030

Qatar approves Saudi Rail Link Agreement, Accelerating Gulf Railway Vision 2030

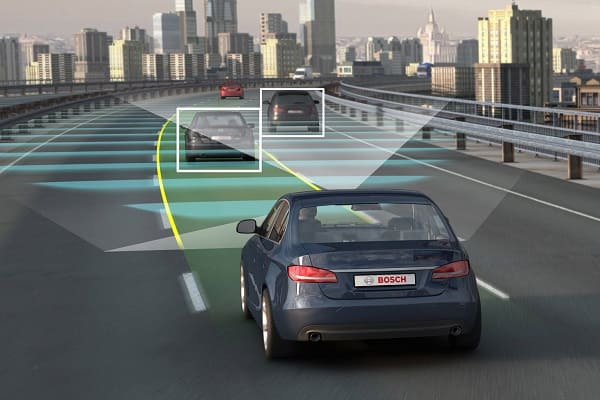

A glimpse into India’s 2024 automotive and logistics landscape

(Representative Image)

(Representative Image)

As India steps into the promising year of 2024, the automotive and transportation & logistics sectors are poised to script a remarkable narrative. India's journey is illuminated by compelling statistics that underscore the pivotal role these industries play in the nation's economy.

India is the world’s third-largest automobile market, with its automotive sector accounting for 7.1% of the country’s GDP. Most recently, it was reported that India's greenhouse emissions rate has dropped by 33% in 14 years. With the automotive sector being in the midst of an electrifying transformation, India is on track to meet a commitment to the United Nations Convention on Climate Change (UNFCCC), to reduce emissions intensity by 45% from the 2005 level by 2030.

On the logistics front, where over 13% of India's GDP is influenced, the state of affairs is equally compelling. With nearly 22 million individuals employed in this sector, which is registering a healthy growth rate of 10% to 12% year-on-year, logistics is the unseen backbone of India's economic engine.

As we stand at this juncture, these sectors are set to navigate challenges and seize opportunities, promising an era where innovation and adaptability will shape the course of India's automotive and logistics landscape. Let's delve into what these emerging trends in these two identified sectors are in India.

Electrifying momentum

The electrification of vehicles is gaining unprecedented momentum in India and this rise of EVs holds immense promise. In the first nine months of 2023, electric vehicle (EV) sales in India has topped the one million mark – a milestone that took an entire year in 2022.

This seismic shift to EVs has attracted the attention of global automakers. Vietnamese EV manufacturer VinFast Auto has announced plans to set up assembly units in India, with production expected to commence by 2026; alongside Hyundai Motor Company's substantial investment for assembling battery packs, underscores the international recognition of India's potential in the EV space.

For the logistics sector, this trend means a paradigm shift towards eco-friendly transport options. Logistics companies should prepare for the transition by investing in electric delivery fleets, charging infrastructure, and route optimisation to adapt to the unique needs of EVs. For example, Amazon India is partnering with Eicher Motors and Buses to further electrify its e-commerce logistics in the country, with the target to deploy up to 1,000 electric trucks over the next five years for its delivery operations.

This surge in EVs not only aligns with India's commitment to environmental responsibility but also resonates with the ambitious target of having 30% of all vehicles powered by electricity by 2030. However, the pressing issue of charging infrastructure remains a bottleneck. While the momentum is clearly in favour of EVs, the country needs a robust network of charging stations to support this revolution. Overcoming this challenge is not just a necessity for EV scalability but a pivotal step towards ensuring the success of India's ambitious electric mobility targets.

Redefining partnerships

India's stance on Chinese automotive original equipment manufacturers (OEMs) has created a ripple effect. With the limitations imposed on foreign entities, it's imperative for India's automotive industry to foster homegrown innovation and self-reliance, aligning with the government's vision of 'Atmanirbhar Bharat' (self-reliant India).

For the automotive industry, this means a newfound focus on indigenous manufacturing, innovation, and reducing dependency on foreign collaborations. Domestic automotive companies now have the opportunity to strengthen their production capabilities, invest in research and development, and explore strategic alliances with non-Chinese OEMs. This shift is expected to drive job creation, fostering the expansion of the automotive sector and contributing to the nation's self-reliance goals.

The logistics sector in India will also play a crucial role in supporting the country towards self-reliance. As indigenous manufacturing gains prominence, the logistics industry will see increased demand for efficient transportation and warehousing solutions. This shift necessitates investments in logistics infrastructure, including warehouses, distribution centres, and transportation networks. Furthermore, logistics companies must adapt to changing trade dynamics and develop new strategies to support the automotive sector's growth. Embracing technology and digitalisation will be crucial for optimising the movement of goods in India’s rapidly changing landscape.

Reimagining logistics

India’s logistics industry is undergoing rapid growth and transformation. One of the initiatives under the National Logistics Policy (NLP) in India is the Unified Logistics Interface Platform (ULIP), which aims to simplify logistics processes, improve efficiency, bring about transparency and visibility, and reduce logistics cost and time.

According to HERE Technologies’ inaugural APAC on the move report, end-to-end asset tracking and shipment visibility remain a challenge for Indian logistics companies three years since the onset of the pandemic. Software integration challenges with existing infrastructure is one of the main barriers for Indian logistics companies to adopt logistics assets tracking and shipment/cargo monitoring solutions. As a such, the ULIP along with turn-key solutions that are easy to implement without expensive, time consuming, and labour-intensive system will benefit logistics firms the most.

With the ULIP in place, businesses can expect streamlined operations, faster movement of goods, and reduced inefficiencies, translating to cost savings and lowering the cost of logistics. The NLP is also expecting to drive more digitalisation and technology adoption within the logistics sector. As such, in the coming year, we can expect the Indian logistics sector to invest more in advanced technologies, such as Internet of Things and cloud computing to maximise the potential of the ULIP, modernise India's logistics infrastructure and increase the country's competitiveness in the global market.

Approaching the 2024 elections

As India gears up for its general election in 2024, the automotive and logistics industries will be under increased scrutiny. Political changes can significantly impact regulations, infrastructure investment, and trade policies, influencing the trajectory of both sectors. Stakeholders within these industries should closely monitor the political landscape, as it will determine the direction of economic policies and trade agreements, which in turn will shape the automotive and logistics environments.

In this exciting and transformative year, the automotive and logistics sectors in India are set to navigate a unique confluence of challenges and opportunities. The shift towards EVs aligns with India's environmental goals and signifies a greener future. The reshaping of partnerships highlights the need for self-reliance and local innovation. The ULIP promises to revolutionise how goods move within the country. And with a general election on the horizon, political dynamics will play a critical role in steering the course of both industries.

As India embarks on this journey, it is crucial for businesses to be agile, innovative, and adaptive. Those who anticipate and embrace these trends will not only thrive in the evolving landscape but also contribute to the sustainable and efficient future of India's automotive, transportation and logistics sectors.