IndiGo to launch Urban Electric Air Taxis between Delhi to Gurugram

IndiGo to launch Urban Electric Air Taxis between Delhi to Gurugram Swisspod secures Strategic Investment to advance the Hyperloop Transportation

Swisspod secures Strategic Investment to advance the Hyperloop Transportation Siemens Mobility revolutionizes Copenhagen's S-bane Network with Driverless Technology

Siemens Mobility revolutionizes Copenhagen's S-bane Network with Driverless Technology Unlocking prosperity between India and Myanmar: The Kaladan Multi-Modal Transit Project

Unlocking prosperity between India and Myanmar: The Kaladan Multi-Modal Transit Project Is the RRTS Truly Accessible to the Common Man or Only the Privileged?

Is the RRTS Truly Accessible to the Common Man or Only the Privileged? Alstom sold its Rail Signalling Technology Business to Knorr-Bremse for €630 million

Alstom sold its Rail Signalling Technology Business to Knorr-Bremse for €630 million Vensa Infrastructure wins ₹412.58 crore civil contract for Hisar Airport

Vensa Infrastructure wins ₹412.58 crore civil contract for Hisar Airport Kuala Lumpur-Singapore high-speed rail project cost could be slashed to RM70 Billion

Kuala Lumpur-Singapore high-speed rail project cost could be slashed to RM70 Billion Nevomo's MagRail Technology Selected for Hyperloop Freight Demonstrator

Nevomo's MagRail Technology Selected for Hyperloop Freight Demonstrator Russia signs deal to procure bullet trains for Moscow - St. Petersburg high-speed line

Russia signs deal to procure bullet trains for Moscow - St. Petersburg high-speed line

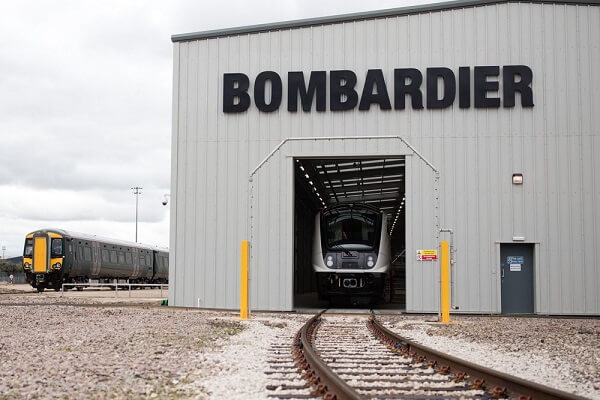

CCI approves Bombardier's Rail Business acquisition by Alstom Transport

New Delhi, India (Urban Transport News): The Competition Commission of India (CCI) has approved the acquisition of Bombardier Transportation's Rail Business by Alstom S.A. and the acquisition of approximately 18 per cent and 3 per cent share capital of Alstom S.A. by Caisse de dépôt et placement du Québec (CDPQ) and Bombardier Inc respectively.

The Alstom S.A. has also received the conditional approval of the acquisition of Bombardier Transportation's Rail Business by European Commission (EU). Both firms i.e. Alstom and Bombardier have entered into a new agreement to finalise the deal on revised price terms.

French firm Alstom is offering a wide range of transport solutions. In India, it manufactures and supplies, inter alia, signalling solutions, rail electrification, rolling stock (including locomotives and metro coaches), track works, maintenance services and it also provides associated construction and engineering services through its subsidiaries, including Alstom Manufacturing India Private Limited, Alstom Systems India Private Limited, Alstom Transport India Limited, and Madhepura Electric Locomotive Private Limited.

Bombardier Inc is a Canadian firm which is globally active in aircraft and rail transport business. Bombardier Transportation is the global rail solutions division of Bombardier that offers a wide range of rail solutions. In India, Bombardier Transportation is engaged in the sale of rail vehicles, propulsion, control equipment and signalling solutions through its subsidiary Bombardier Transportation India Private Limited.

Recently Bombardier has bagged two big Rolling Stock contracts for the supply of modern coaches and signalling systems for Delhi-Meerut RRTS and Kanpur & Agra Metro projects in India.

CDPQ (which is a global long-term institutional investor) manages funds primarily for public and para-public pension and insurance plans. It invests in major financial markets, private equity, fixed income, infrastructure and real estate.